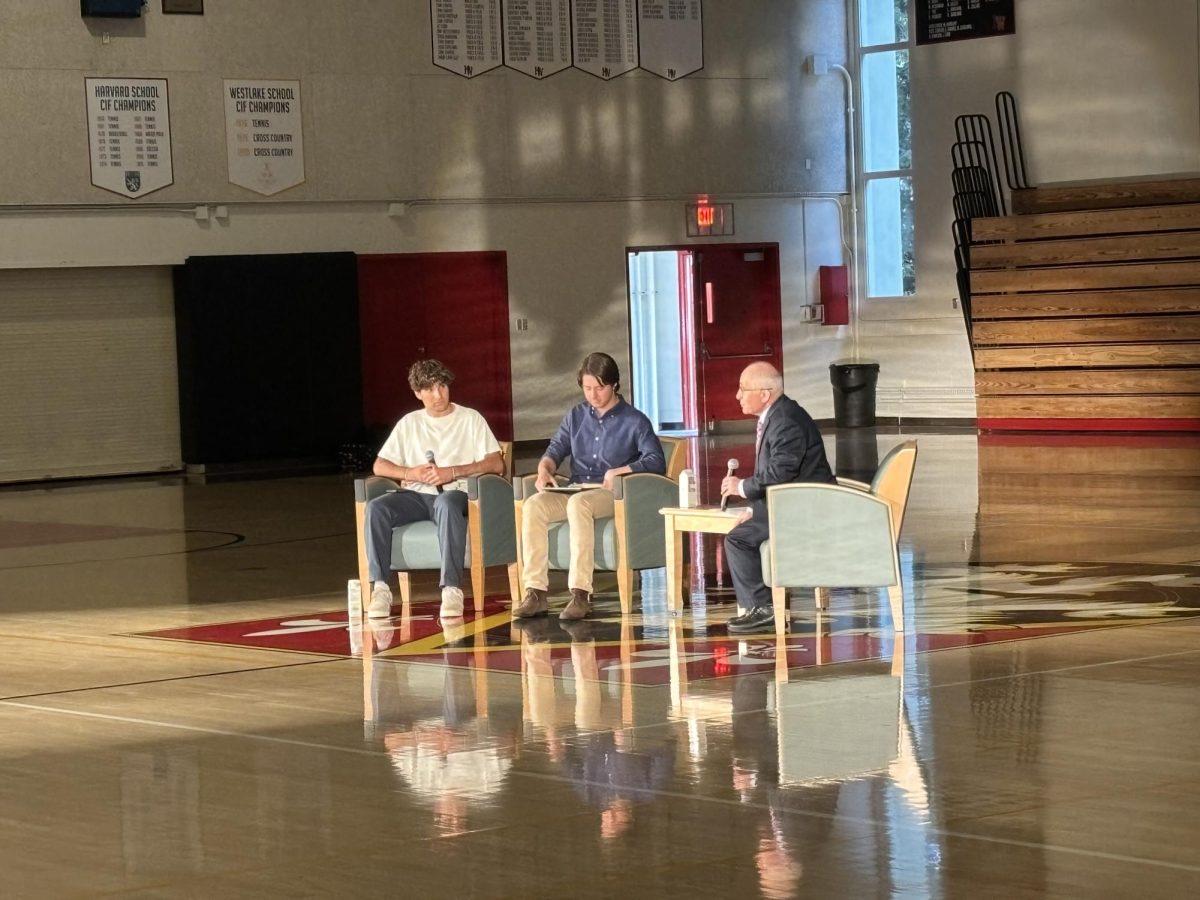

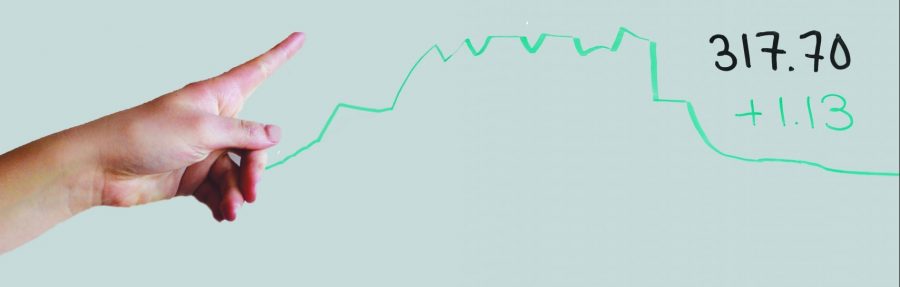

Schramm said he thoroughly researched the companies he invests in, taking into account numerous factors such as new product releases and the status of rival competitors. In early November, for example, Schramm analyzed how Disney+, a new streaming service, would affect the stock market.

“I thought investing in Disney would be a good idea because Disney+ would have a lot of classic movies and [television] shows that many people enjoy, so I spent weeks and weeks researching how it was going to affect the stock, and whether it was smart to invest in Disney before they released the platform,” Schramm said. “I ended up investing, and it actually had a great return. I had 20 percent of my original investment returned back.”

Director of HW Venture teacher Rob Levin said he has seen the benefits of taking risks through personal experiences. Levin said that, many years ago, he bought stocks from multinational conglomerate Berkshire Hathaway, which at the time was $8,000 a share. Now, according to Google Market Summary, Berkshire Hathaway Inc. stock is around $350,000 a share.

“I had two choices,” Levin said. “I didn’t choose the course that had the $8,000 risk, and I chose the course that was ‘risk-free’ . I put the money under a mattress with a lock, key and armed guard, but I lost $342,000 .”

The risks of getting involved in the stock market

Most people worry about the risk of losing money rather than that of not taking a chance, Levin said.

“People have a misguided sense of risk. We evolved to be unrealistically risk-averse,” Levin said. “Our hardwiring is biased since we remember bad things more than good things. Emotionally, we react to negative consequences very strongly. There is a huge, real risk in not taking ‘risk’ .”

Since engaging in the stock market is not a high-stakes hobby for him, Schramm said he likes to invest in riskier stocks which could either result in large returns or financial blunders. After extensive research, Schramm said he invested in five big-name companies, some of which include Bank of America, American Airlines and Roku Inc. Schramm invested in Roku Inc. seven months ago and the company’s return increased by $200 in just one month.

“After the returns increased, I decided to add more money in that stock, and the returns just continuously increased,” Schramm said.

Since investing in the stock market is not a high-stakes hobby for him, Schramm said he likes to invest in riskier stocks which could either give him large returns but could also turn into financial blunders.

Fedor Kirilenko ’20, who invested in the stock market after encountering widespread media coverage of large companies such as Apple and Amazon, said he believes that risk is an integral part of investing.

“What is investment without risk? ” Kirilenko said. “That’s the whole essence of it. You risk some amount of money to extract gains. The question is are you willing to risk a lot or risk a little, because if you risk a little, you only have some amount of gain.”

According to Forbes, 66 percent of people from ages 18-29 are intimidated by the stock market, and 42 percent of millennials invest conservatively. Levin said that people may have been scared away from the stock market due to the stock market crash of 2008, when the Dow Jones Industrial Average stock price fell 778 points .

“The root of the problem is that people were damaged earlier in their careers, and when you look at exponential growth, if you get behind the start you’re never catching up,” Levin said. “If there is excessive caution, there’s a problem.”

Anybody can learn about stocks

Levin said learning about the economy and the stock market is not as difficult as most people perceive it to be.

“To understand when things grow exponentially, whether it’s your money, your debt, the population of a finite planet, a deadly bacteria or an untrue idea is what’s important,” Levin said. “If you understand the time axis and its interactions with random variability, now you’re talking investment wisdom. The Warren Buffets of the world simply have a longer time [understanding the stock market] than others, so the people who are day-trading penny stocks are missing the entire point.”

Teenagers involvement in the stock market

Through stocks, teenagers can not only make some money, but also learn more about the economy, a practical life skill, Levin said.

“Kids can learn how to research and how to find out about companies,” Levin said. “They can learn that even though they don’t know more than the experts, there are still a lot of idiots out there also investing.”

Similarly, Schramm said that teenagers can invest as much as they desire into the stock market.

“People don’t often realize that there’s more than just $1000 stocks,” Schramm said. “I’ve invested in $4 stocks and $60 stocks. There are so many opportunities to actually invest where it doesn’t require a lot of money. Just starting off is important, no matter how much you start off with.”

Junior Prefect Chelsea Cho ’21, who participated in an online trade simulator competition at a summer camp, said that she incorporated what she learned about keeping up with the stock market into her daily life.

“I learned a lot about time management,” Cho said. “Doing stocks, particularly following the New York stock exchange, was really hard due to the time zone difference.”

Economics club president Henry Mass ’20 said investing in stocks has helped him become more politically aware and up-to-date with the news.

“I think starting to invest money when you’re young is important,” Mass said. “You learn important analytical and financial skills while also paying more attention to the news and what’s happening in the world.”

Investing provides not only monetary gains in the present, but also for the future, Schramm said.

“When I’m older, I’m going to want to use every dollar I can to invest, because it’s important to have resources for when something happens,” Schramm said. “I know I’m investing in risky stocks now, but in the future, I can use the money I worked really hard to continue to grow.”