Profitable Nonprofit: Inside Harvard-Westlake’s Tax Records

An analysis of the school’s tax filings reveals it is the wealthiest school in California with $398.7 million in net worth, up 93% over 10 years.

Illustration by Will Sherwood/Chronicle

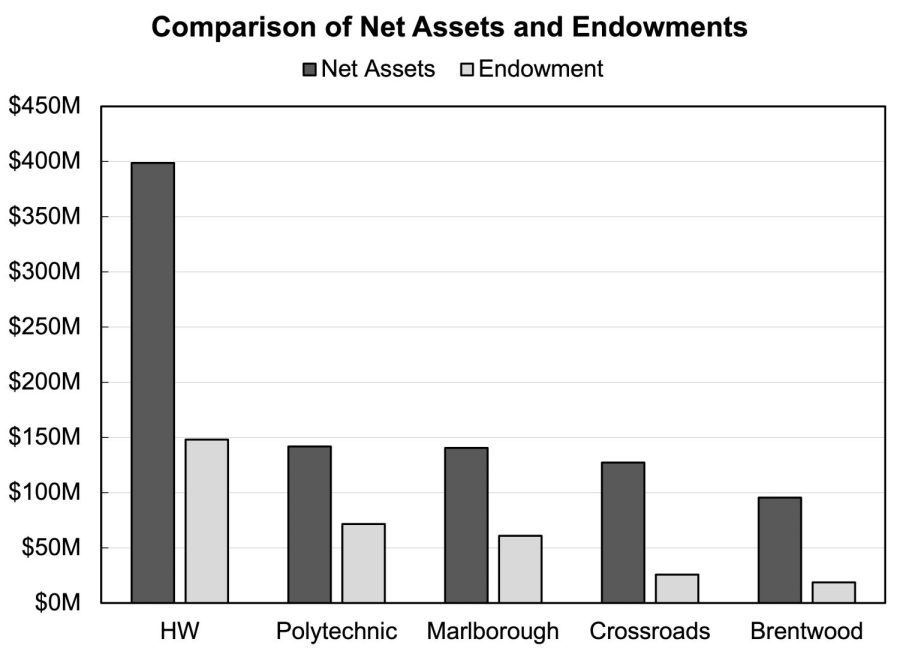

Harvard-Westlake shows real financial strength against its peer schools in Southern California.

January 19, 2022

Featured on its website and published in various brochures, the school’s numerous accomplishments are well known. Today, the school boasts 1,620 students, 206 full-time teaching faculty, more than 300 different classes and $13.8 million in need-based financial aid. Over the past five years, 232 graduates matriculated to Ivy League colleges, and last year, the school won the Cal-Hi Sports State School of the Year Award for most athletic championships.

Less well known, however, is the school’s impressive financial performance over the last decade, making it the wealthiest independent middle and high school in California.

Form 990s, which are collected by the Internal Revenue Service (IRS), are submitted annually by organizations with not-for-profit or federal tax-exempt status. The 990 forms are public and can be accessed on the internet.

An analysis of these filings from 2010 to 2020 reveals the school’s net assets—a measure of the net worth of a nonprofit—grew 93% over the past decade, now valued at $398.7 million. During that time, the school generated $150.2 million of net income, which is the surplus between revenues and expenses. The school’s endowment also increased 280.5% to $148 million. Over the 10-year period, gifts, contributions and grants totaled $241.7 million.

Chief Financial Officer David Weil said the school spends each summer reviewing its finances and preparing these tax returns, which provide a detailed accounting of every dollar that is received and spent, the value of assets and investments and compensation of its top employees.

According to Weil, the Form 990s for the 2020-2021 fiscal year have been completed but have not yet been finalized with IRS and are not available to the public.

Still, the 2019-2020 Form 990 depicts the school’s financial success and position compared to other independent schools in the region. The school’s $398.7 million in net assets and $148 million endowment are more than double those of Polytechnic School ($142 million; $71.7 million), Marlborough School ($140.4 million; $60.8 million), Crossroads School ($127.3 million; $25.8 million) and Brentwood School ($95.5 million; $18.8 million).

Harvard-Westlake’s net assets and endowment are significantly greater than those of other prestigious independent boarding and day schools in California including Thacher School in Ojai ($277 million; $168 million), Cate School in Carpinteria ($177 million; $111 million), and Nueva School in Hillsborough ($133.7 million; $13.6 million).

Compared to significantly older independent schools on the east coast, the school’s financial position is more modest. Phillips Andover Academy in Massachusetts, founded in 1778 after the American Revolution, had net assets of $1.4 billion and an endowment of $1.1 billion in 2020. Groton School in Massachusetts, where President Rick Commons served as headmaster from 2003 to 2013, had net assets of $414.6 million and an endowment of $358.7 million in 2020.

The school’s $179 million of investments in public and other securities have likely risen in the last 18 months, as the S&P 500 Index, a broad measure of the stock market, has delivered a total return of 23% during this period. Weil said the school’s investments grew during 2021.

“From a Wall Street perspective, 2021 was a very strong period, which is ironic, given what was going on in society,” Weil said. “We are typically close to 100% in equities with regards to our investment portfolio. So during a year in which the S&P 500 repeatedly reaches an all-time high, fairly quickly that increases the size of our investment portfolio, our endowment, and the money that we take out of the endowment to support current operations. The one thing to keep in mind, though, is that for every $1,000 that our investment portfolio increases by, we don’t have $1,000 in benefits to our operating budget. We only take out 4.5% of that $1,000.”

Under Commons’s leadership, the school’s financial position has grown significantly. The school’s net assets (total assets minus liabilities) have increased 37.2% from $269.8 million in 2013 when he arrived to $398.7 million in 2020. During that time, annual revenues have grown to an average of more than $100 million a year. The school’s revenues come mainly from tuition, contributions and investment income. Expenses have also increased from $68.9 million in 2013 to $88.6 million in 2020.

In 2013, the school had 686 employees, according to the filings. That number peaked at 780 employees in 2017 and decreased to 708 employees in 2020. Expenses on salaries and wages at the school have gone up from $26 million in 2013 to $34.1 million in 2020, an increase of 30.8%. When Commons arrived, 45 personnel were compensated more than $100,000 annually. By 2020, that number had risen to 104, an increase of 131%.

When asked how he would grade the school’s financial performance during his tenure, Commons said the entire community deserves high marks and expressed gratitude to all the people who made such success possible.

“I would grade [the school’s financial performance] an A,” Commons said. “That’s a hard-earned A. It’s been earned through the generosity of our parents and alumni and the management of our business office, led by David Weil and advised by our board of trustees.”

During Commons’ tenure, gifts and donations to the school have totaled $171 million, according to the school’s tax filings. He said this philanthropy is a core strategy in the operation of the school.

“[One of the aspects of the school’s financial strategy] has been to rely on the generosity of our parents and alumni to help us achieve important strategic goals without relying on increases in tuition that are either unmanageable for families or disconnected from the rate of inflation,” Commons said.

During the 2012-2013 school year, the school tuition was $31,350, according to Chronicle archives. In 2021, tuition rose to $42,600, an increase of 35.9% during Commons’ tenure. The cumulative increase in the Consumer Price Index, a standard measure of inflation, was 19.68% during the same period, according to inflation calculators on the Internet.

At the same time, program spending—what the school spends on academic and other programs—kept pace with the rise in tuition. Total program spending has grown from $50.4 million dollars in 2013 to $67.9 million in 2020, an increase of 34.6%.

At around $42,500 dollars, the school’s spending per pupil is more than double the national median for independent day schools. Median total expenses per student in independent day schools were $21,193 in 2020, according to the National Association of Independent Schools (NAIS).

The school’s endowment per pupil–another common statistic—has skyrocketed from $24,403 per student in 2010 to $92,620 per student in 2020, an increase of 279.5% and nearly five times the national median for independent schools. The national median endowment per student was $19,136 in 2020, according to the NAIS.

NAIS Vice President of Media Myra McGovern said the financial differences between independent schools across the country are substantial and vary widely.

“I think the most important thing to remember is that independent schools vary a great deal,” McGovern said in an email. “There are start-up schools that hold classes in church basements, and there are 300-year-old boarding schools with campuses that are larger than many colleges. Even schools that may seem like peers in terms of academic reputation could be structured quite differently.”

Asked which financial accomplishment during his tenure makes him the proudest, Commons said he is most thankful about the growth of the endowment by 131% to $148 million.

“I’m grateful to our parents and to our alumni for making it possible for us to significantly increase our endowment during the time that I’ve been at school,” Commons said. “That endowment supports chiefly our faculty and staff and our recipients of financial aid. I won’t say I’m proud of it. I’m enormously grateful for it. And rather than taking credit, I express gratitude. It’s not that I have done this. It’s actually our parents and alumni who have done it. And I’m proud to stand beside them and express my thanks.”

The school’s investments in public securities have grown significantly over the past decade. In 2010, the school had $42 million invested in public securities. By 2020, investments in public and other securities had grown to $179 million, an increase of 326%.

Amidst movements across campuses for colleges and universities to divest from fossil fuel companies and private prison industry stocks, Weil said the school does not have any direct investments in these types of equities, only indirect investments through indexes like the S&P 500.

“We know a significant portion of our holdings in the investment portfolio are [directly] in the S&P 500 index,” Weil said.”So while we don’t directly own [fossil fuel] stocks, indirectly through one or more of those S&P 500 companies, we do. And as far as I know, we do not own or make profit off the prison systems.”

The school’s campuses are situated on 22 acres of land in Studio City and 12 acres in Holmby Hills. The book value of the land alone is $64.6 million, according to the school’s 2020 tax filings, while the buildings are valued at $95 million. Over the last decade, the value of the school’s land, buildings and equipment has increased 13% to $170 million.

In 2017, the school spent more than $40 million to purchase Weddington Golf & Tennis, the 16-acre property in Studio City that will be turned into the Riverpark athletic campus. The project will cost around $100 million, according to Chronicle archives.

Commons said COVID-19 has created budgeting challenges for the school with many unanticipated expenses like testing and protective measures on campus. At the same time, the school has also been able to reduce expenses in certain areas like travel, attendance at conferences and sports season adjustments. He said Weil and the school’s business office deserved praise for handling the financial complexities of the pandemic.

“You might ask him how in the world he’s pulled off that magic trick because we have managed to break even despite all of those unpredictable expenses and [because of] all those unexpected savings,” Commons said.

Weil said the money the school saved by operating virtually during the pandemic was used to cover emergency costs as well as to help families in need.

“Financially, there were ways in which the pandemic and the shift to virtual learning eliminated certain programs that we would normally operate,” Weil said. “So it was almost as though the ways in which we design our budget under normal circumstances didn’t apply to the way in which our school was operating for that 18-month period. What that did was free up resources that allow us to then redeploy in areas that are of more immediacy, as a result of the pandemic, towards emergency financial assistance for families, who in some cases had never needed assistance before, or for families who were receiving assistance from us previously, but who now needed to focus on food insecurity.”

McGovern from NAIS said that while many independent schools faced financial uncertainty during pandemic, most managed to cope with the pressure.

“Thankfully, the majority of independent schools saw just small drops in enrollment in the first year of the pandemic (although some saw large losses and others saw growth),” McGovern said in an email. “And although markets fluctuated a great deal at first, they rebounded. Throughout the pandemic, most schools have been focused on how they can keep students and teachers safe, continue to deliver the programming families want, and ensure that the school’s finances will allow it to deliver on its mission long into the future.”

Weil said over the past 18 months, the school spent $1 million on assistance for families and another $1 million on COVID-19 related expenses.

“We ended up spending a million dollars on emergency financial assistance on top of the financial aid budget that we normally set aside,” Weil said. “We spent well over $1 million on different raw COVID-19 costs, masks, testing, ventilation, cleaning, and on the reconfiguration of how our buses operated.”

Commons said the school has three immediate financial priorities going forward. First, he said there are significant fundraising goals to be met in order to begin work on the River Park Project.

“We have more money to raise in order to be ready to break ground on River Park,” Commons said. “So that is a very important goal, to raise enough money to be able to cover the costs of the facilities that we intend to build at River Park.”

Second, he said he hopes to continue to grow the endowment in order to expand the financial aid program. Today, according to the school’s website, 20% of students receive financial aid.

“I want very much for us to continue to build our endowment so that we can increase the number of students receiving financial aid at [the school], ” Commons said. “We’re north of 20% now. I would love to see that number climb to 25% or 30%.”

Finally, Commons said he wants to continue to support the employees who serve as the foundation of the school.

“Our faculty and staff are so critical to the experience at [the school],” Commons said. “We need to be able to compensate our employees in a way that makes it possible for them to live relatively close to school so the commute is not unmanageable and [so they can] take care of their families.”

Rob Levin • Jan 28, 2022 at 8:19 pm

Will —

Kudos on this superb research and presentation. You’ve invested the hard work necessary to get facts in depth and to place them into perspective.

Only a couple notes from my end:

First and foremost, I am enormously proud of how my successor (and long-ago student), Mr. Weil, stewarded the School and its families through these difficult times. Extraordinary!

Second, two of the facts you’ve shared could benefit from additional perspective:

Yes, our endowment is larger than that of many other premier West Coast independent schools and well-above the per-student NAIS average. However, even after strengthening substantially during the Commons era, it still trails (much smaller) schools such as Cate and Thacher on a per-student basis.

The total employee count of 686 can also mislead. More than half are part-time, including some Middle School coaches who work at HW only a few hours a week. More germane is the tally of 206 full-time teachers which you cite, along with roughly 100 deans, administrators, administrative staff, and members of the maintenance, business, advancement, IT and admission teams.

Thank you, though, for sharing superb insight into HW’s financial strength and the hard work done by so many to build it.

As always, I remain a huge fan of this nation’s finest student newspaper!!