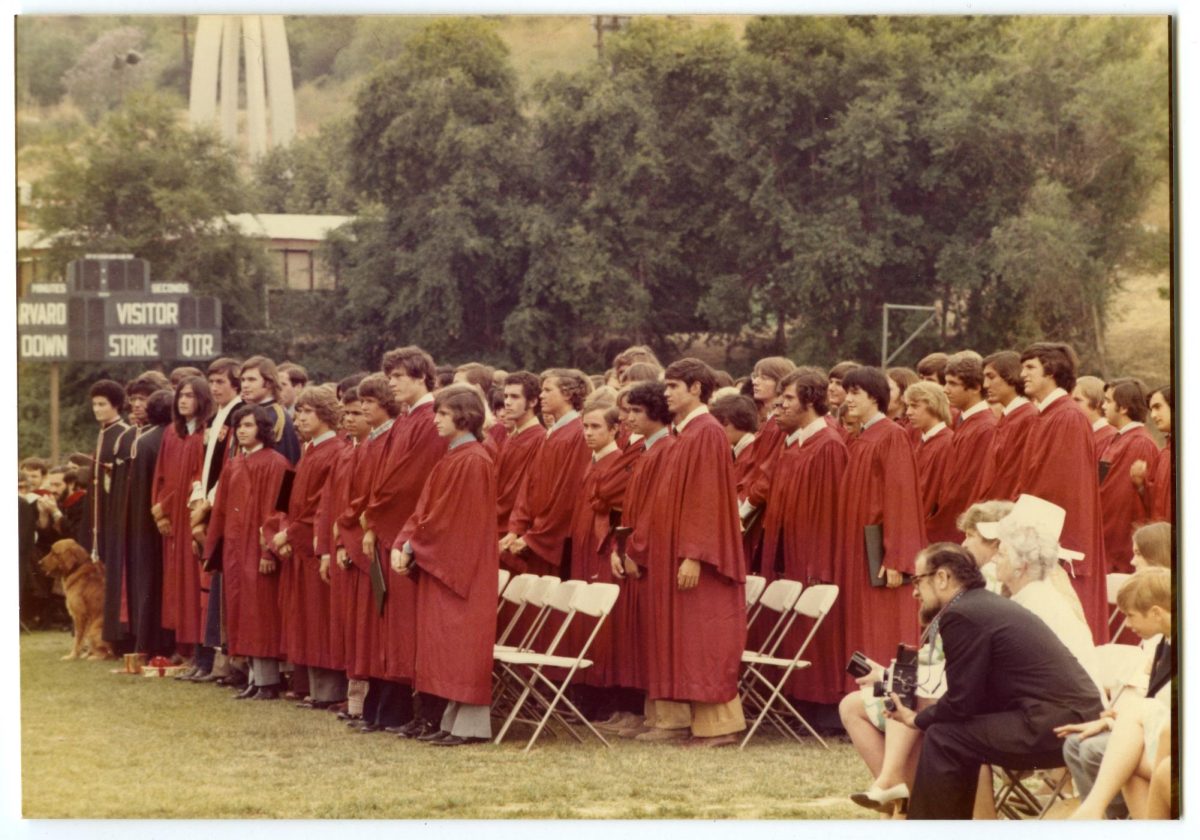

Schools finances surge during pandemic

The school broke financial records this past year.

August 29, 2022

While the losses resulting from the pandemic seem incalculable, the school’s tax returns for 2020-2021 tell a different story. In a year when its campuses were closed and its community reeled from the effects of COVID-19, the school’s financial performance broke all records, with net income surging 327%, according to its latest tax filing. Total assets, a measure of the school’s net worth, grew to $520.8 million, up 25.9%, driven by investments in the booming stock market and record fundraising.

From July 2020 to June 2021, the school’s net income –– the profit of a not-for-profit organization –– totaled $39.3 million, according to the school’s Form 990, which is submitted annually to the IRS by organizations with tax-exempt status. It was the most profitable year in the school’s long history, exceeding its previous record of $31.8 million in 2016, according to the returns visible on the internet.

In 2021, total expenses dropped 2.4% to $5 million. While tuition increased 4% to $41,300 during the 2020-2021 year, the school reduced its program expenses for its 1,624 students by 4.4% to $64.9 million.

Chief Financial Officer David Weil ’93 said because the school’s annual budget is planned ahead of time, many of the funds allocated for canceled activities during the 2020-2021 school year and events were redirected, but the still lower than expected expenses left a larger net income than normal.

“Come May 2020, with just two months’ experience with online [schooling] and a rapidly-changing COVID-19 landscape, school administrators and the Board of Trustees passed the 2020-21 budget and, conservatively, assumed a regular school year replete with events, sports, travel, conferences and the like,” Weil said in an email.

“Fast forward a year, and many of the expenses we’d expect to incur for those types of activities were redeployed for significant, supplemental financial aid, PPE, COVID testing and measures to facilitate a return to campus, leaving a slighter greater operating surplus than we typically budget.”

In January, a Chronicle article on the school’s tax returns over the last 10 years showed that despite its not-for-profit status, the school generates millions of dollars every year in net income and has accumulated hundreds of millions of dollars of total assets, easily making it the wealthiest independent middle and high school in California. Indeed, over the last 11 years, the school has generated a total of $189.5 million in net income or profit.

President Rick Commons said much of the credit for such financial growth should go to the Board of Trustees, who are responsible for overseeing the school’s investments.

“A lot of [our success] is thoughtful investment on the part of the Board of Trustees and experts who have knowledge that I don’t have with regard to how to make sure that we make the right investments at the right times,” Commons said. “But we’re lucky to have a pretty talented Board of Trustees, so I give them credit.”

Commons also pointed to the experience and teamwork of the administration as major contributors to the school’s success.

“I think we have been blessed by a very stable leadership situation,” Commons said. “You go around the leadership team, and it is a group that is stable. There isn’t the turnover that many schools have experienced. Some of that is good luck, but some of it is that this is a great place to work and people want to be a part of it. I think that is reassuring to people when they’re not only sending their kids to school here but considering investing in the place.”

In 2021, the school’s total assets grew to over half a billion dollars, driven mainly by investments in publicly traded and other securities, which increased 40.9% to $252.3 million.

During this time, the school’s total endowment increased 30.8% to $201.8 million, also propelled by the performance of its investments.

Weil said that although much of the success seen in the Form 990 came from investment returns, only a small percentage of the total endowment is available for spending.

“Our Finance Committee and Board of Trustees long-ago adopted a policy that limits our endowment draw to 4.5% of the average portfolio balance for the trailing 12 quarters. That discipline is specifically designed to smooth out large ups and downs that would otherwise flow through to operations.”

In 2021, gifts, contributions and investment income drove a 28.6 percent increase in total revenues. The school took in a total of $125.8 million, breaking the previous record of $116.3 million in 2019.

Gifts and contributions in 2021 increased 111% to $49.2 million, from $23.3 million in 2020. Head of Advancement Eli Goldsmith said that a number of factors make philanthropic support necessary for the school.

“I think the case for support at Harvard-Westlake has never been greater,” Goldsmith said in an email. “Unlike many large universities that are fully endowed, Harvard-Westlake’s endowment only supports about 10% of operating expenses. This places a heavy burden on both Annual Giving and on tuition, which, I should add, remains below the median of our local peer schools. Harvard-Westlake’s needs are significant and would not be met without the philanthropic support of our [school] community.”

In terms of staffing, the number of school employees dropped 7.8% to 652 — the lowest number in more than a decade. Also, the number of employees paid more than $100,000 dropped 13.5% to 90.

The administration is mindful that this year’s financial performance may suffer by comparison because of declines in the stock market since January 2022 and the highest inflation in decades. Weil said although inflation could make life difficult for the community, the school has plans in place that are meant to help employees and their families.

“Inflation is our focal point given the potential that persistent, high levels of inflation might have on the economy and, as a result, on our school community,” Weil said. “With the cost of living in Los Angeles already high relative to other cities, inflation reduces the likelihood of real wage growth and, if not addressed, could lead to a reexamination of priorities and some difficult choices. Harvard-Westlake is very well prepared for the current environment, having grown our financial aid programs and accelerated employee compensation while remaining below the median tuition of LA high schools, but the economic impacts of inflation are absolutely something to watch.”

Commons said although current economic circumstances can be challenging, he has faith that the school will continue to thrive in years to come.

“Harvard-Westlake has such a tailwind of incredible students, incredible teachers, a community that believes in the place and is willing to to back it in so many different ways, financial and otherwise, [so] I’m confident that we will weather whatever conditions come.”