By Andrew Lee

Risk aversion is on the minds of investors across the world. Regulators are nervous as they pore over loan portfolios and watch the credit crunch trickle down from Wall Streetâs mega-banks to smaller firms. The economic slowdown triggered by a housing slump in the U.S. has created a very volatile market. Investors are facing the biggest bear market of the last decade, and some of them are high school students.Â

At least 20 upper school students have individually invested between $1,000 and $10,000. In trying times, it is difficult to find a window of opportunity. They are struggling to keep their heads out of the water as markets worsen. While some of them have part-time jobs, most invest using allowance from their parents.

Some dumped existing portfolios and shifted their focus toward alternative investments. Others are bullish on battered stocks, waiting for the market to turn around in the third quarter of 2008. As the financial hub of the world, the health of the U.S. has the biggest impact on the global economy.Â

âThis is a very tough game to win,â NYU Stern School of Business professor Aswath Damodaran said. âI think it requires a lot of homework. It requires persistence.â

In light of the unease in the markets, popular areas of investment among students are sources of alternative energy, including solar and wind power. Efforts to go green have created a sizable emissions market and a new tradable commodity with tremendous speculative bets. Currently, the market is fleeing to more traditional commodities as safe havens and squeezing their margins. Atleast six students believe that alternative energies is a viable industry that will compete with escalating oil prices in the long run.

âI think the current economic slowdown is only temporary,â Lawson said. âEven though all of my stocks have taken a beating, Iâm going to hold on to them until the markets regain stability.â Four other students like Lawson decided on holding onto their losing stocks.

Dennis Cho â09 has been investing on KRX, the Korea Exchange, for five years. Analyzing and researching cross-border stocks from his personal computer, Cho finds that there is a very close relationship between KRX and the New York Stock Exchange. The U.S. credit crunch has had a big impact on all of his stocks, Cho said.

âMany Asian exports are shipped to the states,â Cho said. âWith the recession in America, there are less Korean exports being bought in the U.S.â

Cho quickly sold all of his stocks in the construction, motor and electronic industries because their profits relied on American sales. Upon cashing out, he shifted his focus toward steel and telecommunications, two industries where demand is constant and unchanged.

Ryan Navi â09 got into stock trading in the seventh grade after he saved up money from a summer job working at a bookstore. He pored over business magazines and newspapers and found a personal interest in the technology sector. Though Naviâs shares fell an average of 15 percent through March, he believes the current state of the markets is a unique experience that

teaches a valuable lesson.Â

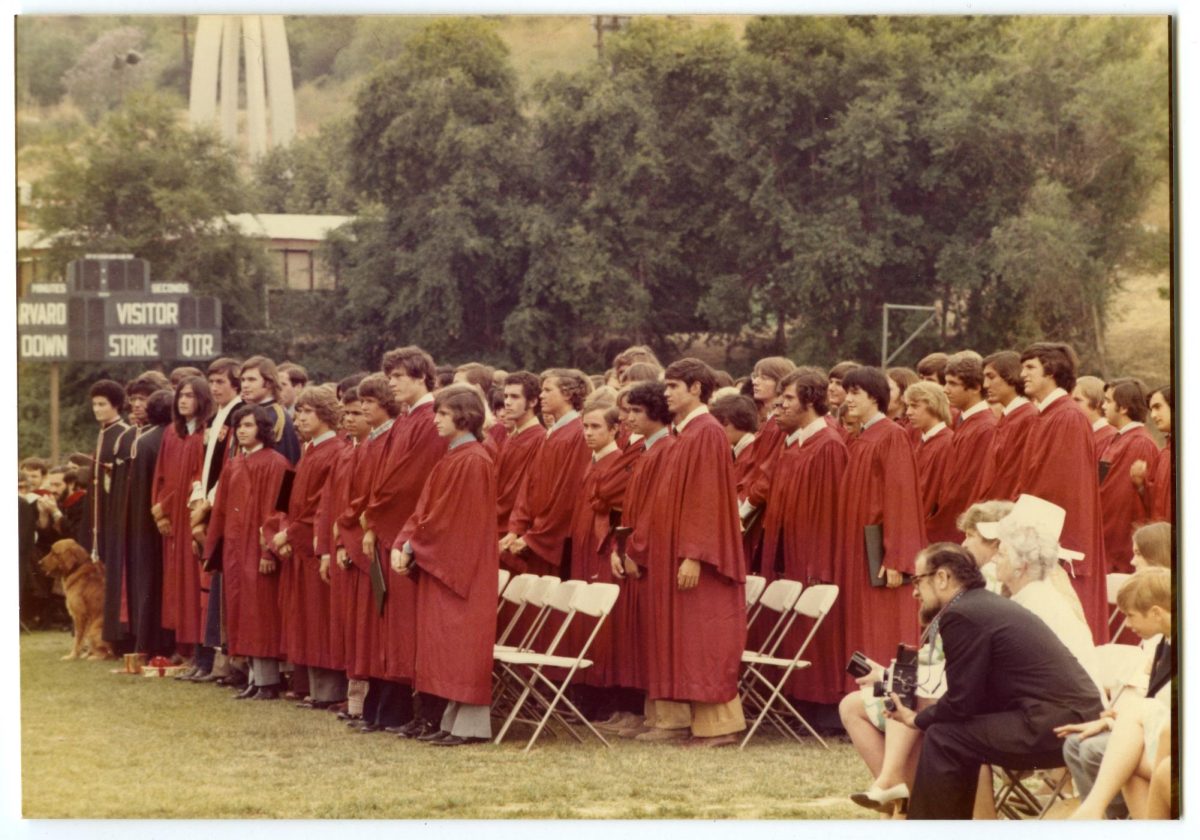

âIâm really interested in finance and Iâm involved in Harvard-Westlake Exchange,â Navi said. âI hope to take these experiences with me later on in life.â Navi recently used the money he made in stocks to help buy a car.

Tymon Tai â08 is a strong believer in commodities. Using money from Chinese holiday gifts and family allowance, Tai is long on gold and uranium. With hours of homework and other extracurricular activities, he does not always have the time to fit stocks into his schedule, he said.

âThis isnât what I want to do as a future career,â Tai said. âBut I want to learn how to put my financial resources to good use and not sit on my money.â

Tai has decided to pause his stock investments until the turbulent market picks up. He sold all of his shares and believes he will be able to return to his hobby when he enters college this fall. He hopes to devote more time and to take a more rational approach upon speculating stocks using more calculations, he said.

Three students primarily invest in penny stocks, hoping to capture their tremendous upside potential. Trading at one cent per share, the sky is the limit. Brandon Wilton â09 tries to investigate every variable of a companyâs shares before he invests in hundreds of thousands of penny stocks.

âI realize that trading stocks is really not as easy at it seems,â Wilton said. âFinding a booming stock without a cult following is very difficult.â Penny stocks are driven by momentum and quick turnovers cause them to be extremely risky, Wilton said.

âThere is simply too much volatility in the market to value long-term growth and speculation,â Rory Handel â09 said. âUntil the credit turmoil and market for loans recovers, I think the best way to win is to closely follow the evolving market and make quick, in-and-out transactions.â

Economics teacher Kent Palmer warns students that high-volume, short-term investments can often be no different from gambling.

âThe stock market has generally been a more reliable way to make money over long-term investments,â Palmer said.

Alex Steiner â09 has experienced both bitter and sweet economic movements this year. He was able to sell gold at its peak in March, but also lost big when he invested in homebuilder materials right before the subprime mortgage crisis. Despite his losses, Steiner remains optimistic and enthused over the learning experience.

âIâm actually happy that I bought losing stocks,â Steiner said. âDownturns are where you can make the most money, and itâs a great opportunity for me to see how the market works at an interesting time like this.â

Over the course of the summer, Steiner hopes to master all variables of the stock market by concentrating on numbers and calculations, not simply by going with a âstory that looks cool.â

â[Trading stocks] requires that you understand yourself best before you start investing,â Damodaran said. âThere are enough openings in the market that somebody who really understands what theyâre doing and knows their strengths and weaknesses can take advantage of those openings.â